Liquidity management

Secure liquidity reserve in all situations

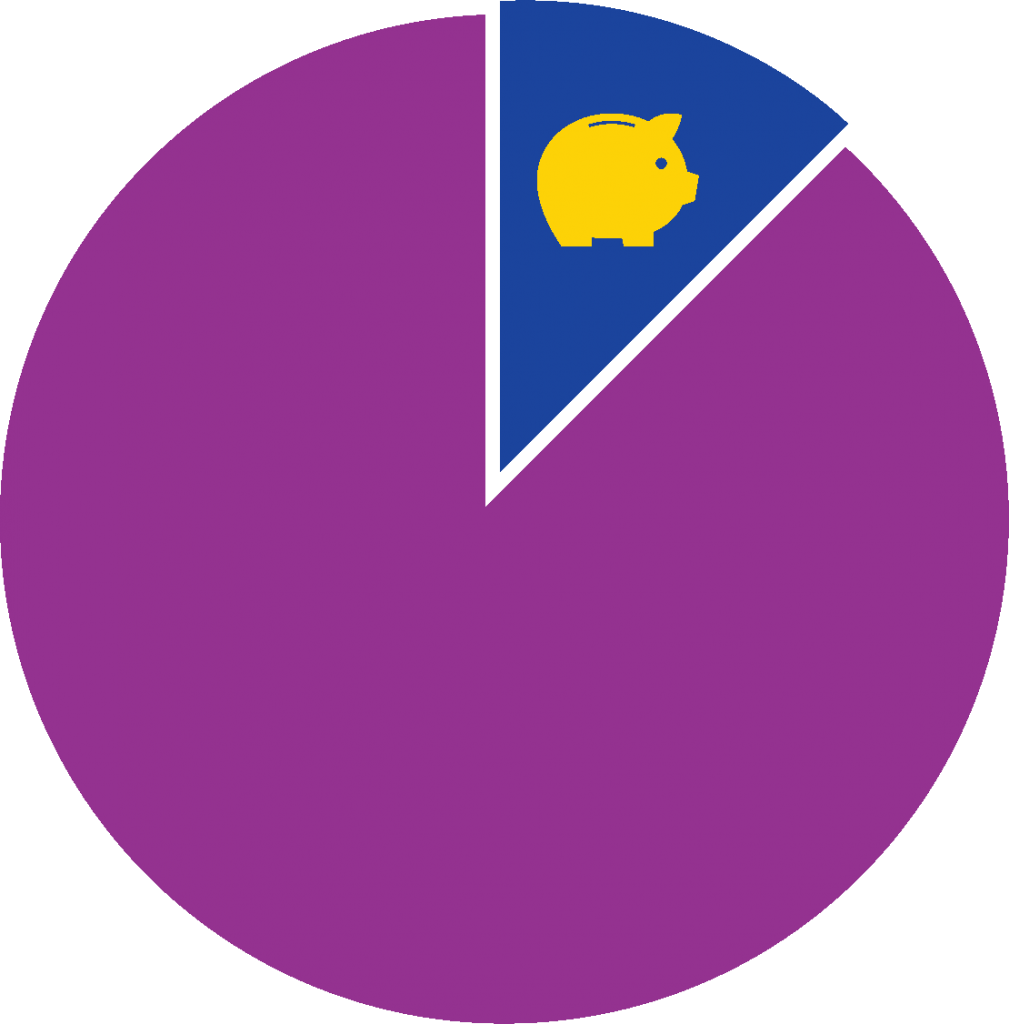

A large proportion of the liquidity reserve shall be eligible as collateral at the Riksbank, that is, accessible even when market conditions prevent sales of assets.

Investment rules for the liquidity reserve

- Investments shall primarily be made in securities issued by sovereign states or nationally guaranteed financial institutions.

- Investments may only be made in counterparties with a credit rating of at least A2 from Moody’s and/or A from Standard & Poor’s.

- Investments may have a maximum maturity of 3.25 years.

- The Kingdom of Sweden (the Swedish state) is approved as counterparty without further decisions being required. For borrowers outside Sweden, a borrowing limit is applied on a per-country basis.

RIX membership strengthens liquidity readiness

Kommuninvest’s membership in the Riksbank’s RIX payment system strengthens its access to liquidity in the event of turbulence in the financial markets, since this provides the opportunity to participate in the Riksbank’s money market transactions and to access daylight and overnight credit facilities.