The local government sector

Funding

- The average annual increase of the local governments debt 2010-2022 was 6.5 percent.

- The growth rate in 2022 was 2.7 percent, the lowest since Kommuninvest started collecting data on municipal and regional funding in 2007.

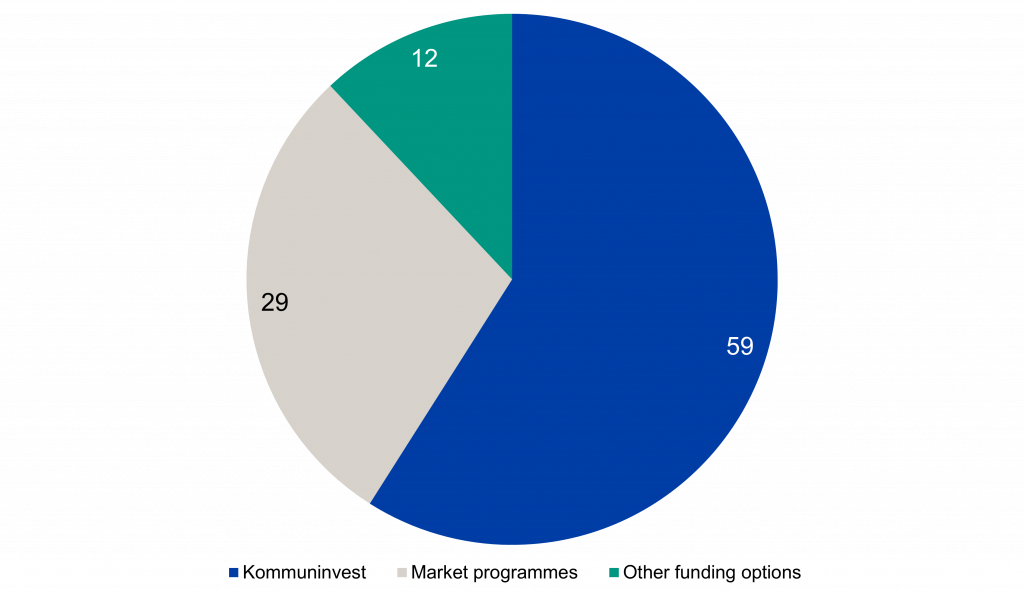

- Borrowing through Kommuninvest and the municipalities’ own market programmes are the two dominant funding options for Sweden’s municipalities and regions.

Trend & analysis

Market shares have recently been rather stable. At the end of 2022, Kommuninvest’s market share is estimated to 59 percent, the market programmes to 29 percent and other funding options to 12 percent.

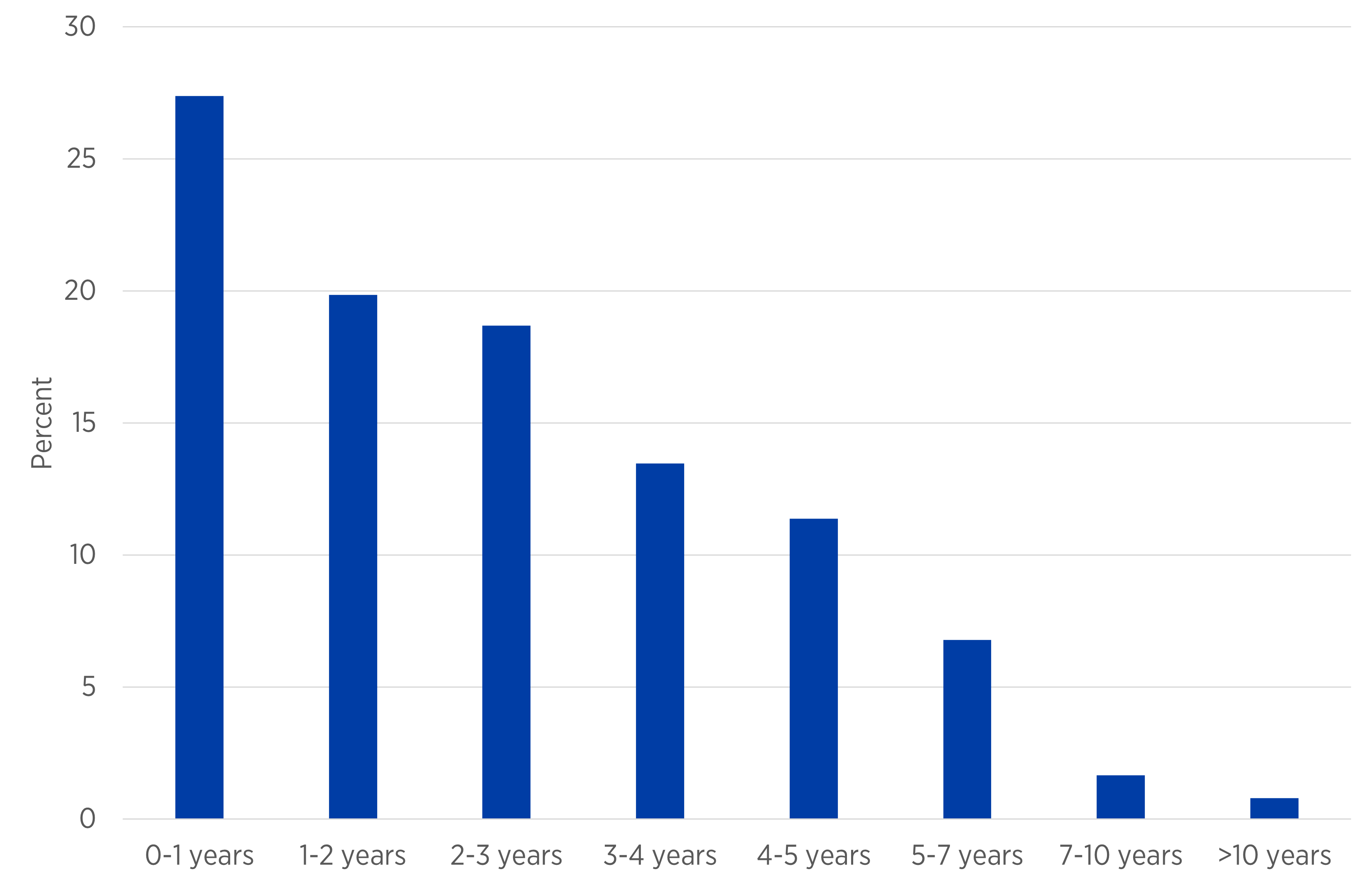

Maturity profile

- The average maturity was 2.5 years.

- 27 percent of the debt matures within 12 months.

- 9 percent of the debt has a remaining term longer than 5 years.

Trend & analysis

Swedish local governments have a relatively short average maturity, 2.5 years at the end of the fourth quarter 2023. This means that investments are funded with borrowing that needs to be renewed several times during the economic life of the investments.

27 percent of the loan portfolio matures within one year, of which 20 percent is made up by short term funding, such as commercial papers, which are extended three to four times per year.

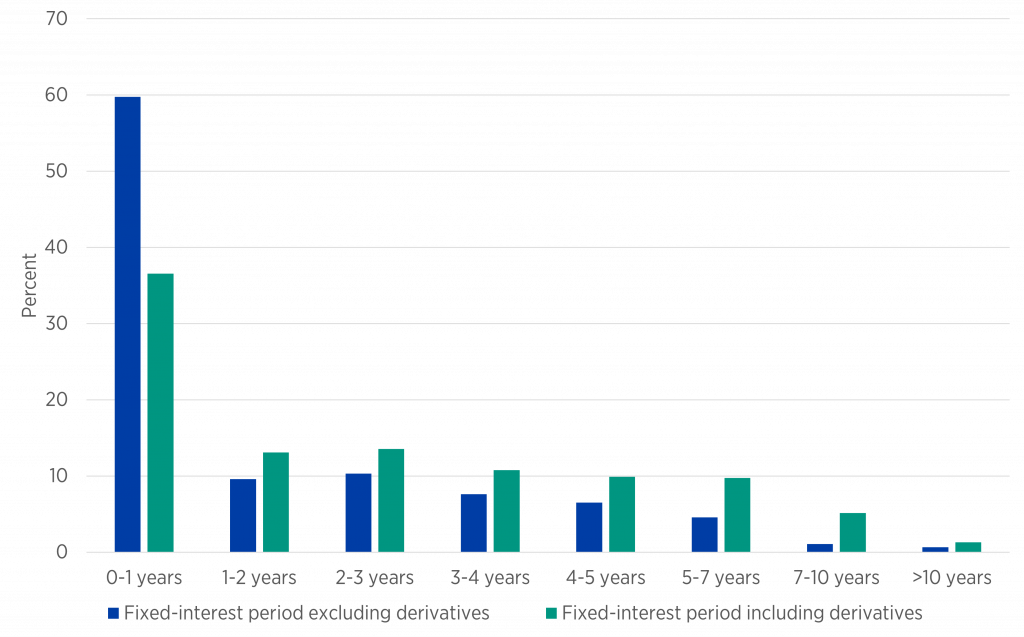

Financial derivatives

- 48 percent of the borrowing is linked to a floating interest base, primarily 3M Stibor.

- Through the use of derivatives the fixed-interest period extends from 1.53 to 2.65 years.

Trend & analysis

Many municipalities, regions and municipal companies fund their investments with loans that have short maturity. Some municipal actors use interest rate swaps to extend the fixed-interest period. This means that the average period of fixed interest matches the average maturity on the funding.

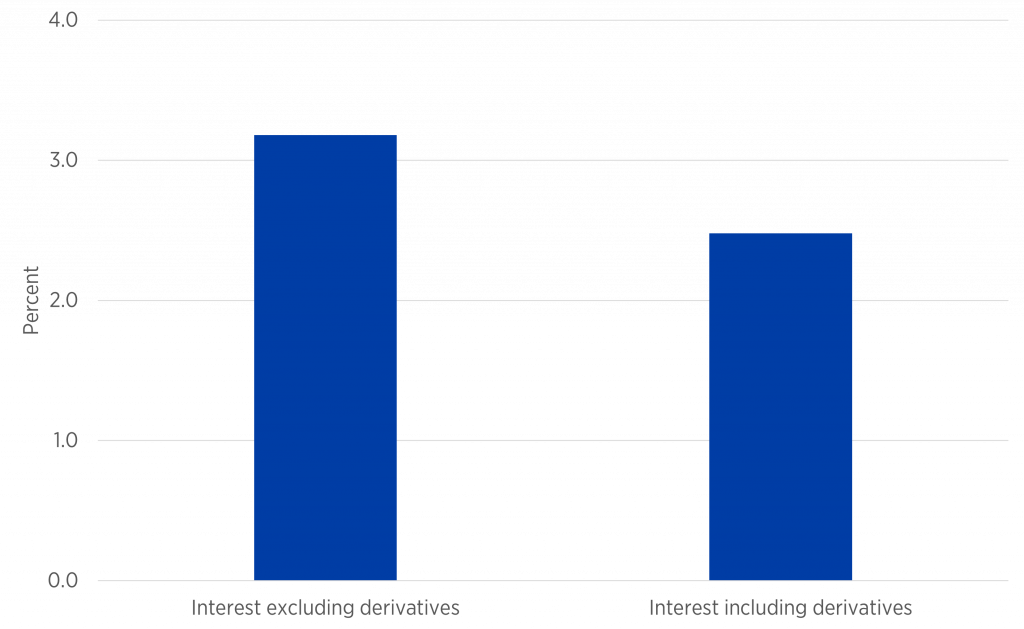

Interest rate level

- Average interest rate excluding derivatives was 3.18 percent.

- Average interest rate including derivatives was 2.48 percent.

Trend & analysis

The funding costs for the municipal sector have increased drastically during the last two years. The average interest rate increased by 17 basis points in comparison with the previous quarter to 2.48 percent.